aurora sales tax rate 2021

The Sales tax rates may differ depending on the type of purchase. The Aurora sales tax rate is.

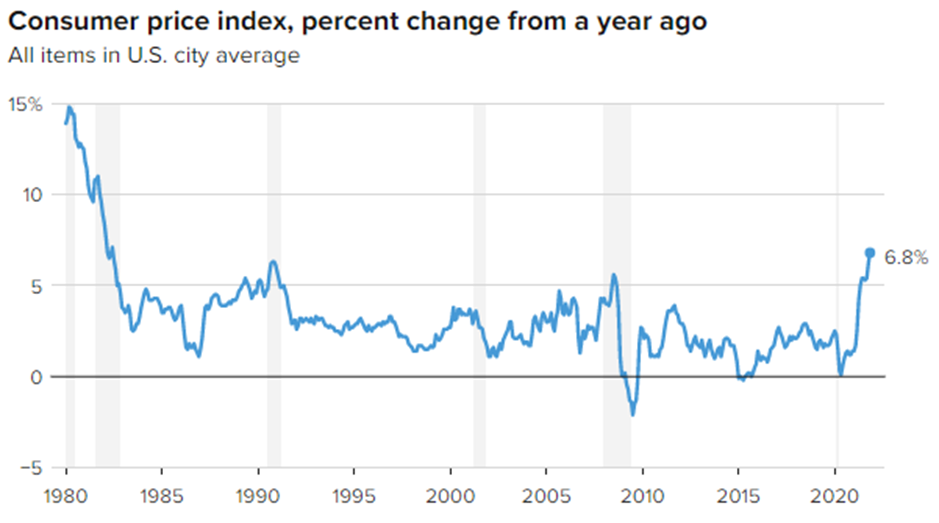

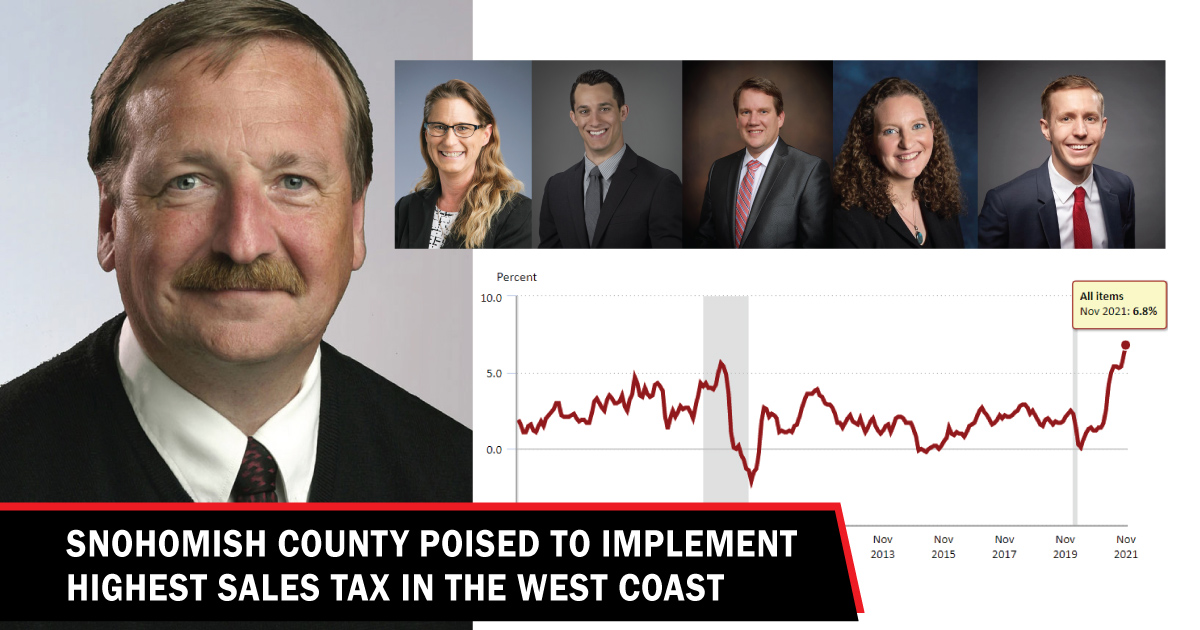

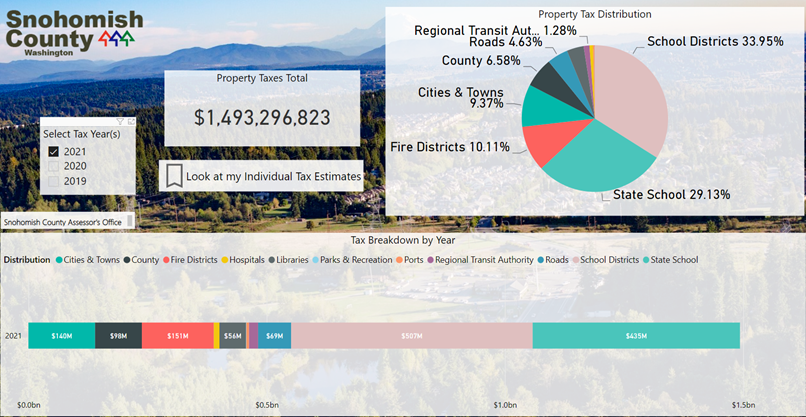

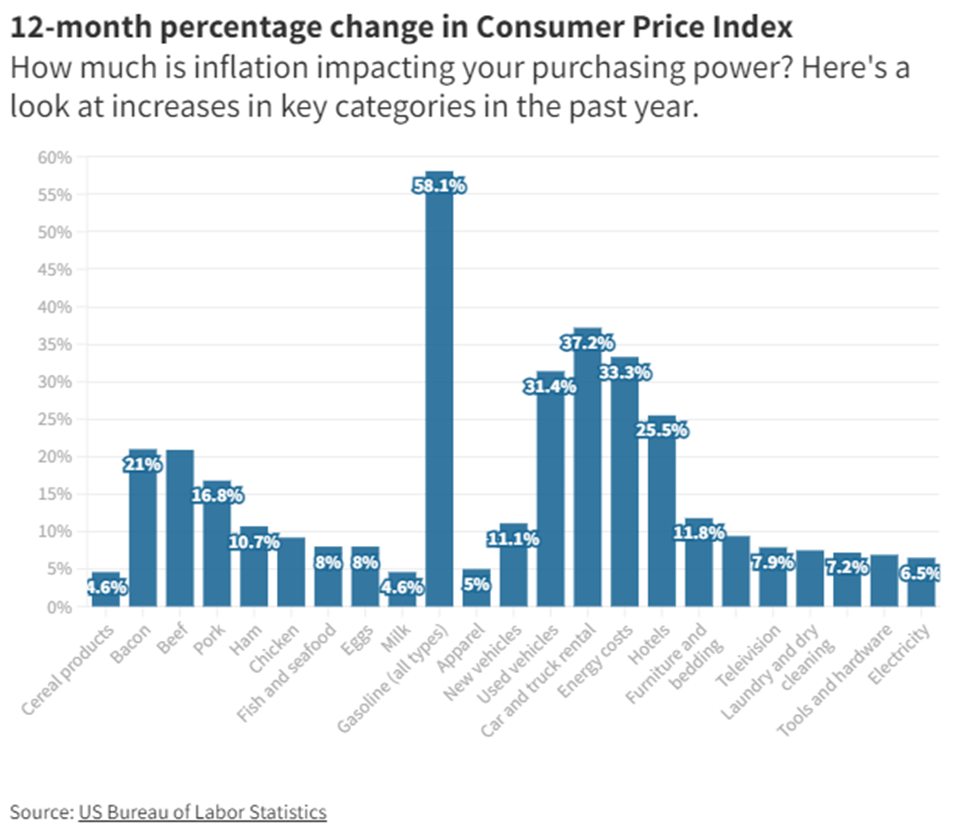

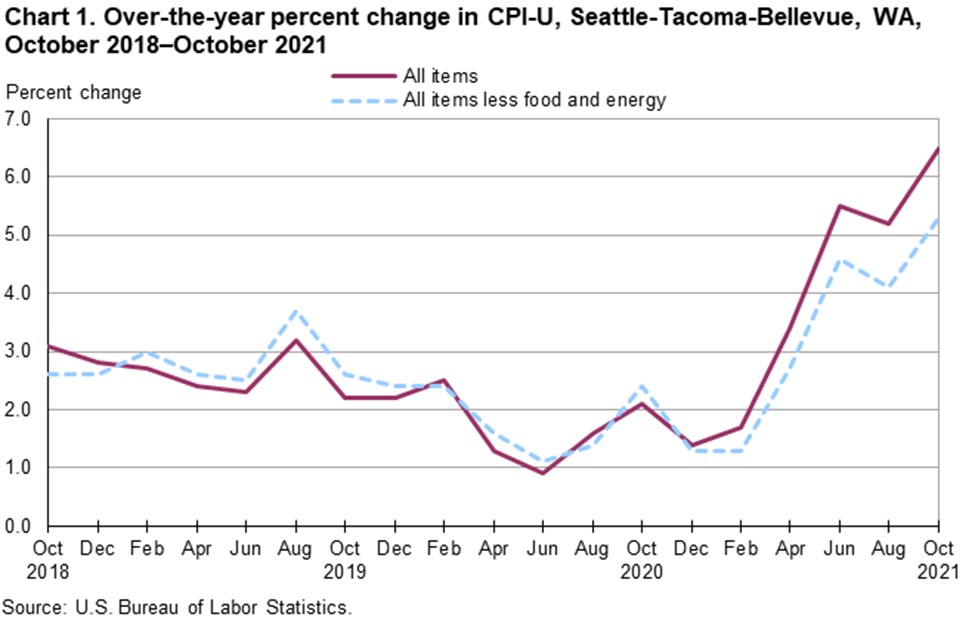

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Austinburg OH Sales Tax Rate.

. The December 2020 total local sales tax rate was also 5500. Avon OH Sales Tax Rate. Total sales tax revenue for the three months ending in May 2022 was up 157 compared to the same period last year.

One of a suite of free online calculators provided by the team at iCalculator. You can print a 85 sales tax table here. Aurora Sales Tax Rates for 2022.

Commercial Payment In Lieu General Rate - Excess Land. Wayfair Inc affect Missouri. Aurora-RTD 290 100 010 025 375.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. Paul Dillman Created Date. Method to calculate Aurora sales tax in 2021.

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. Ava OH Sales Tax Rate. Friday January 01 2021.

44 E Downer Place Aurora IL 60505. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Wayfair Inc affect Colorado.

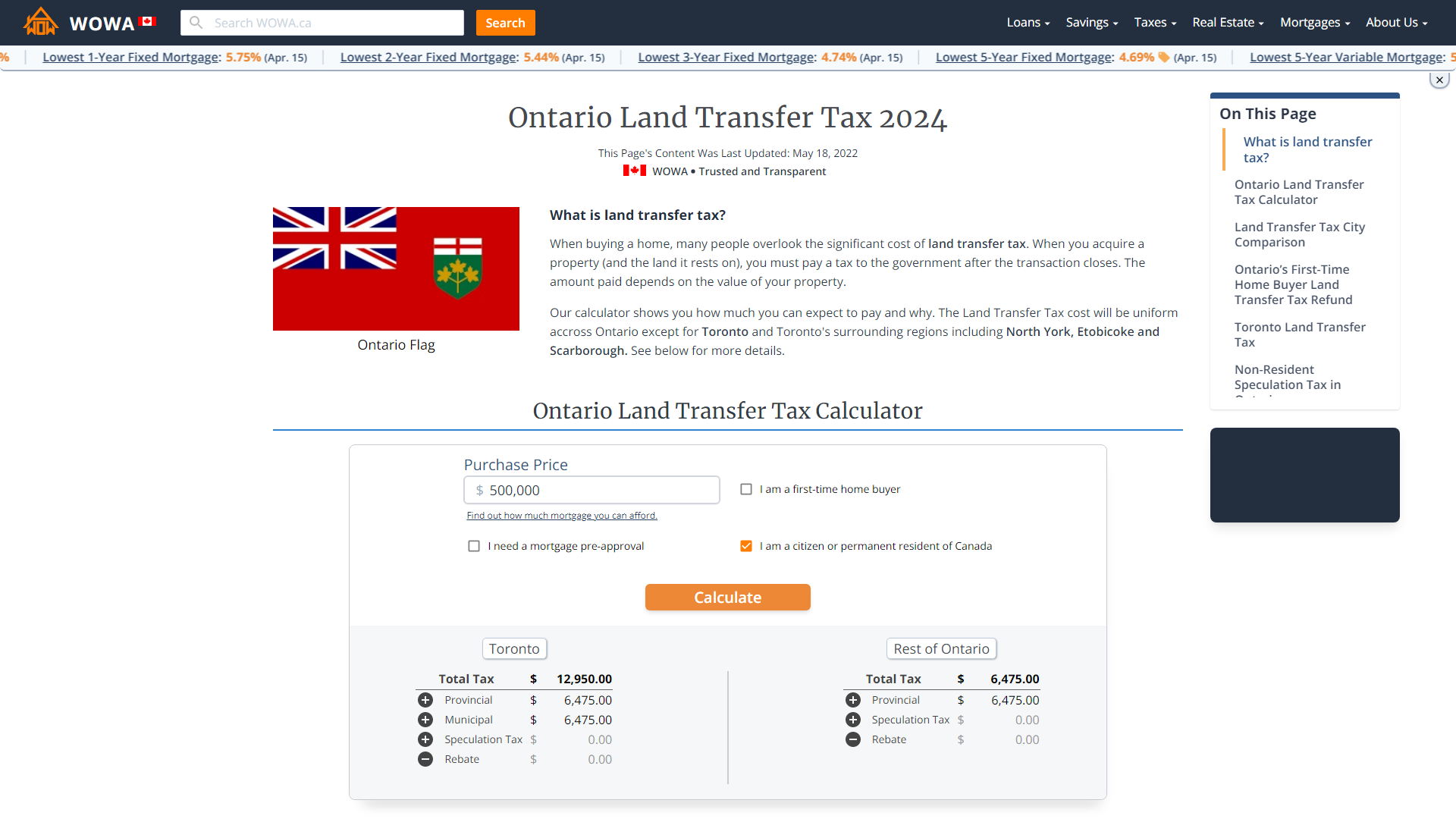

Aurora property tax rates are the 9th lowest property tax rates in Ontario for municipalities with a population greater than 10K. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. This new tier structure will be in effect beginning January 1 2021.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. The Aurora sales tax rate is. 2021 PROPERTY TAX RATES.

What is the sales tax rate in Aurora Missouri. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. Free sales tax calculator tool to estimate total amounts.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. 24 lower than the maximum sales tax in CO. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

The County sales tax rate is. This is the total of state county and city sales tax rates. This new rate structure will have little to no impact on approximately 80 of customers.

The Aurora sales tax rate is. The 8 sales tax rate in aurora consists of 29 colorado state sales tax 025 adams county sales tax 375 aurora tax and 11 special tax. Method to calculate Aurora sales tax in 2021.

The Aurora Sales Tax is collected by the merchant on all qualifying sales. Aurora in Utah has a tax rate of 63 for 2021 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Aurora totaling 035. The County sales tax rate is.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. Did South Dakota v. The Aurora sales tax rate is 1.

Method to calculate Arapahoe. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. 2021 Tax rates for Cities Near Aurora.

You can print a 825 sales tax table here. What is the sales tax rate in Aurora Colorado. The Colorado sales tax rate is currently.

Footnotes for County and Special District Tax. Below you can find the general sales tax calculator for Aurora city for the year 2021. The average sales tax rate in Colorado is 6078.

Most customers use only around 5000 gallons or less during the winter and between 7500 and 8000 gallons per month annually. Sales tax is the largest source of funding for the state budget accounting for 59 of all tax collections. The minimum combined 2022 sales tax rate for Aurora Colorado is.

There is no applicable county tax. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables.

Did South Dakota v. TAX CLASS TAX CODES. For tax rates in other cities see Illinois sales taxes by city and county.

The Aurora Nebraska sales tax is 550 the same as the Nebraska state sales tax. Effective December 31 2011 the Football District salesuse tax. The current total local sales tax rate in Aurora CO.

Austintown OH Sales Tax Rate. This is the total of state county and city sales tax rates. This clarification is effective on June 1 2021.

Look up 2021 Ohio sales tax rates in an easy to navigate table listed by county and city. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. In May sales tax revenue was 369 billion up 86 from May 2021.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected.

For tax rates in other cities see Colorado sales taxes by city and county. Aurora Sales Tax Rates for 2022. City Final Tax Rate.

The minimum combined 2022 sales tax rate for Aurora Missouri is. The average sales tax rate in colorado is 6078 Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

In April it was 38 billion up 128 from April 2021. The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities. Residential Property Tax Rate for Aurora from 2018 to 2021.

Method to calculate Arapahoe County sales tax in 2021. 1281 per month service charge. Aurora OH Sales Tax Rate.

The Colorado sales tax rate is currently. The Missouri sales tax rate is currently. Best 5-Year Variable Mortgage Rates in Canada.

You can print a 825 sales tax table here. 275 lower than the maximum sales tax in IL. 5312021 11625 PM.

The December 2020 total local sales tax rate was also 8000. The current total local sales tax rate in Aurora CO is 8000. The current total local sales tax rate in Aurora SD is 5500.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

2nd Tax On Receipts Confuses Customers At New Walmart Youtube

Sales Tax By State Is Saas Taxable Taxjar

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

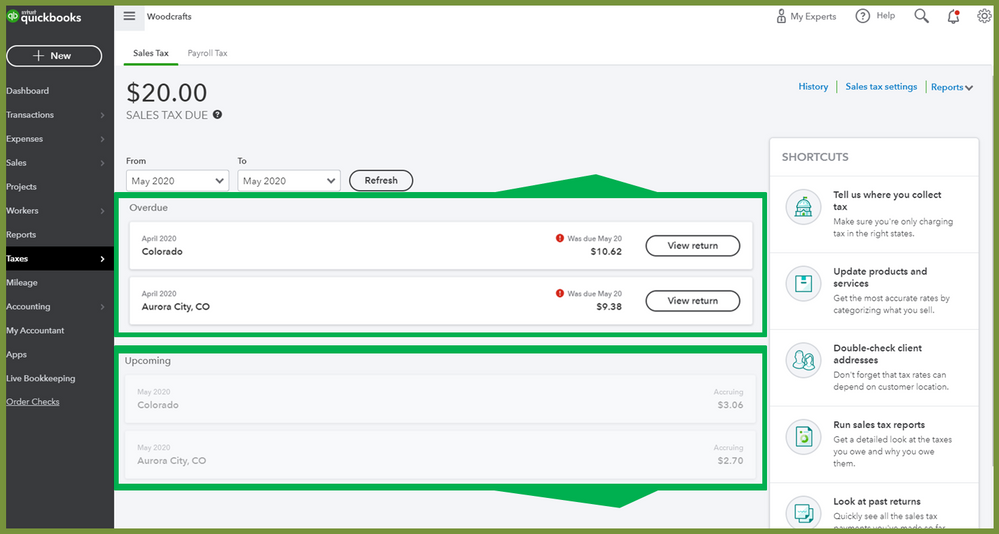

Set Up Automated Sales Tax Center

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Set Up Automated Sales Tax Center

Who Pays The Least Property Tax In Ontario The Answer May Surprise You Alex Irish Associates